|

| Angelika/Mike Schilli |

|

|

|

Michael Alas, people who are leaving their jobs do enjoy protection under the so-called COBRA law ("Consolidated Omnibus Budget Reconciliation Act", Rundbrief 11/2004) at the federal level, regardless of whether the employee or the employer terminated the employment. Cobra grants every employee the right to continue their health insurance, which they had through the company, for up to 18 months after leaving the job. The advantage: you get the same benefits and don't have to worry about being accepted into a private health insurance. The catch: you pay about 5 times as much as when you were still employed, since the company typically covers about 80% of the costs and only demands a contribution of 20% from the employee. In concrete numbers: an Apple employee pays about 380 dollars a month for health, dental and eye insurance (all separate in America), while a former employee pays a total of 1,600 dollars. Straight from your savings, without the possibility of deducting it later from taxes.

To continue your health insurance coverage under Cobra, one must traverse a obstacle course through the worst of American bureaucracy. Here, three different parties are involved: the employer, the Cobra administrator, and the health insurance company. It would be most sensible to give notice before leaving, in order to keep one's health insurance by paying for it out of pocket when you've left. However, this is not so simple, as the employer will immediately notify the health insurance company of the employee's departure, who will receive the message by regular mail a few days later. Which is when it will abruptly reject all incoming medical bills with a date after the end of the employment relationship.

By the way, many employers pay the contributions for a former employee until the end of the month they've left the company, which is why it is often advantageous to leave at the beginning of the month. Apple, however, stops health insurance coverage immediately at the end of the last working day. On that day, two letters are sent by mail, one to the Cobra administrator (a third party) and one to the health insurance. After receipt, the health insurance stops all payments as mentioned. The Cobra administrator, on the other hand, writes to the former employee, again by regular paper mail. In the letter, the former employee learns how to register for Cobra online with the Cobra administrator. If the former employee then pays the first monthly rate by direct debit, he is covered retroactively (!) since his departure from the company.

In my case, I had already known months in advance that I wanted to quit my job, and I had already thought about what would happen if I went to the doctor in the first two weeks after leaving the company. In this time frame, the health insurance does not consider the former employee as insured, and does not know anything about a possible Cobra extension. I only found vague statements online about this topic, but apparently no one had actually tried it. As luck would have it, both Angelika and I had scheduled doctor appointments shortly after Day X, and since I am naturally curious about what happens in borderline cases, we did not reschedule the appointments, but simply kept them. Now, to be fair, if these would have been sixfold bypass operation costing millions of dollars, I might have reconsidered, but it was only normal office visits, which can quickly cost 400 dollars in America, and I thought it was worth the risk, just for the benefit of having fun finding out what would happen.

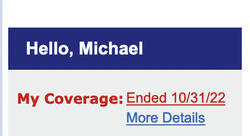

On October 31st was my last day at work, and on November 1st Angelika had a dentist appointment. Interestingly, our insurance paid the bill without hesitation. However, the payment for my doctor's appointment a week later was rejected by the health insurance with the justification of "not insured" and the doctor sent the bill to me instead. I left it on my desk for the time being, and in the third week of November the Cobra documents arrived by US mail. I logged in online to the Cobra administrator's site and immediately paid the first bill for November by direct debit. This is highly unusual in America because everything is paid with a credit card, but it was the only option in this case. The website was very rustic, and I didn't receive any confirmation email. From some former colleagues I knew that the insurance coverage begins with the payment of the premium, retroactively. However, when I logged in to the health insurance's online portal the next day, it still said "not insured". You need nerves of steel for that. Two days later, my payment to the Cobra administrator cleared from my bank account, but the health insurance still apparently didn't know anything about my Cobra coverage. So the next day, I called the customer service of the health insurance and the lady in the call center even patched through to the Cobra administrator and finally told me after 20 minutes that I should wait another 24 hours and then my health insurance portal page would be updated.

And so it was. So I called the doctor the next day to clarify the matter with the invoice rejected by the health insurance. If you don't work, you have lots of time for things like these! I suggested to the billing lady to resubmit the invoice to the health insurance, for which the lady on the phone even found a menu option in their billing software. The whole thing would take 30-45 days, she said, I should ignore all incoming invoices and reminders in the meantime. Well, let's hope it works out! In case of emergency, you can of course also settle the invoice privately and later submit it to the health insurance for reimbursement, but that only creates unnecessary paperwork.

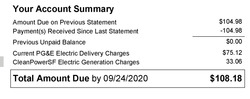

To sum it up, it would have been an extremely risky move to quit my job at my advanced age before Obamacare. After 18 months, Cobra runs out and the former employee has to find a private health insurance, which can be very expensive or even impossible with increasing age and various ailments. In 2010, Obama pushed through the "Affordable Care Act" (ACA) with Congress, among other things, that health insurance companies must accept everyone and are no longer allowed to charge higher premiums due to "pre-existing conditions". Since then, a reasonably decent health insurance (albeit with high deductibles) can be obtained for a two-person family for around $400 a month, and the state of California even provides additional support for low-income earners.