|

| Angelika/Mike Schilli |

|

Michael Every time we book a rental car on vacation, the agent behind the counter brings up the question on how to insure the car. In California, rental car agencies are required by law to provide liability insurance at no extra cost with the rental. In case of an accident, it covers bodily injury to other people and damages to their cars. But watch out, these policies only cover the minimum required by law, which is a measily $30.000 in California. You're personally on the hook for any damages exceeding this amount, which can easily occur if you scrap someone else's luxury car or run over a pedestriant. Especially with severe bodily injury cases or even fatalities, damages can easily go into the millions in our litigious country. People who live here usually already have insurance for their cars at home, and the contract typically also covers rental cars while on vacation. But read the fine print of your contract to make sure this actually applies to your personal situation.

Secondly, there's the question on how to insure the rental car. Who's going to pay if some bum smashes the side window on a parking lot in a tourist location? What happens if there's tire damage or if a pebble hurled up by the next car on the highway hits the windshield and leaves a crack? What happens if the rental car gets stolen? The car rental companies offer insurance products for these scenarios as well, it costs about $15 per day to cover them, but I always decline such offerings while looking straight into rental agent's pretend-horror faces. I always leave covering the extended liability to my home car insurance and the collision/theft coverage to my credit card. For example, my American Express card provides collision/theft protection if I use it to pay for the rental. Ironically, last time we went to Hawaii on vacation, we've found ourselves in the somewhat unfortunate situation to verify how that will actually play out.

It happened on the first day, right after we had arrived at our vacation rental location from the airport. I had the very clever idea to back up the rental car on the place's rather steep driveway all the way to the house's doorstep to avoid having to haul our luggage up by hand. Hertz had given us a Mazda 3 with an generously sized trunk with dimensions not easily fathomable by simply turning your head and peeking through the rear window from the driver's seat. To get up the steep incline, I stepped on the gas in reverse quite a bit, and didn't notice until I heard an infernal noise that a stone wall had been in the way, protruding diagonally upwards from the ground to about 2 feet on its highest end.

It wasn't until a few days later, that I realized that our rental car actually sported a rear facing camera projecting live video onto the dashboard, to allow the driver to follow along what's happening behind the car going in reverse -- and to prevent exactly this kind of mistake from occurring. Oh well! Anyway, the damage had been done, and the car's rear had been badly dented. The giant piece of plastic, serving both as trunk backwall and bumper, was in a rather wretched condition. I tried to get the plastic to pop out again by pulling it outwards like The Hulk, but a few very visible slashes and scratches remained.

When we returned the car at the end of our vacation, one and a half weeks later, I pointed out the damage to the rental car return agents at the airport, and they politely filled out an incident report form for me, featuring long columns of numbers, to which I simply added a verbal description of the incident and my signature. Then, we swiftly proceeded to the departure gate, to catch our flight home to California. We boarded the plane and flew out, relieved to have gotten everything over with so quickly -- in order to be prepared to deal with any unforseen issues without time pressure, we had arrived at the rental car return place an hour ahead of time.

At home in San Francisco, I pulled up our Amex credit card's insurance web page at yourrentalcarclaim.com, and it took all of 15 minutes to click through and submit the claim forms. Shortly after, I received an email, and a day after, another one, assigning an agent to the case.

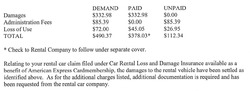

Then, nothing happened for three weeks, until a letter arrived via regular mail, sent by "Viking Billing Services", which started with the words "You recently rented a Hertz car". Apparently, this was sent by Hertz's collection agency, and as you can see in Figure 4, they asked us to pay a total of $490.37. A closer look revealed, that the repair of the car amounted to $332.98, and on top of that, Hertz charged $72.00 for "loss of use", which are rental fees for the repair days the car couldn't be rented out to other customers, and an "administration fee" of $85.39.

I dialed the phone number listed on the collection agency's letter, got a very professionally sounding young man on the line and told him that my Amex credit card would cover the cost. I confirmed my name, my address, and the claim number I had received from Amex when I reported the incident. That was it! Two weeks later, we received a letter from Amex, to confirm that of the demanded $490.37, they had paid exactly $378.03 (Figure 5) to Viking. The car repair of $332.98 they had covered in full. Of the $72.00 charged by Hertz for loss of use, they paid only $45.05. The remaining $26.95, as well as the "administration fee" of $85.39 was left for me to pay, just as the Viking agent had already warned me about that Amex might not cover. So I was stuck with a total of $112.34, which, when Viking sends me the bill, I will pay by check.

To summarize, I have to say that Amex did a pretty good job resolving the claim. Sure, those extra "loss of use" charges and the fishy "administrative fee" trumped up charges they didn't cover may raise some eyebrows, but at least I know now that I can rely on the insurance provided by the credit card when getting a rental car going forward. I guess that being on the hook for a few hundred dollars is a calculable risk not only for me, but for most people. The process seems to work, and proves that the extra collision insurance that is aggressively being peddled by the car rental agencies is not required at all if your credit card contract's fine print offers the same insurance. I have no intention of ruining another rental car, of course, but it's comforting to know how to resolve any issues that might arise from the rental process. I'll keep using my Amex card for future rentals, knowning I'm in good hands if things go south.